His breakthrough idea was that companies wanted to consolidate on fewer vendors. And the company enjoys strong customer loyalty and market penetration. More than half of its customers are Fortune 500 companies, and the remainder includes Global 200 enterprises and major government agencies.

- That percentage will likely rise as the cybersecurity landscape gets more complex.

- CrowdStrike Holdings Inc. is a holding company with subsidiaries that offers a robust cybersecurity platform.

- The standard approach to cybersecurity was to use hardware systems – like firewalls – for on premises environments.

- Data center switching orders continue to register solid year-over-year growth in the fourth quarter of fiscal 2025, implying strong demand.

- We focused on companies developing solutions designed to protect against malware, phishing attacks, and ransomware.

Infrastructure monitoring and content delivery networks

Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success. All the devices around us connected to a network are protected thanks to cybersecurity companies. If you want a long-term investment in an established and even more promising field, cybersecurity might be for you. If you aren’t looking to invest in individual cyber security stocks, maybe a cybersecurity ETF is more for you.

This security is accomplished through procedures, hardware, and software. Our editors independently research our articles and review the best products and services. We may receive commissions on purchases made from links in articles. All information provided is for educational purposes and is not investment advice or buy/sell recommendations. One little-known company—almost entirely overlooked by most AI investors—could be the ultimate backdoor play.

In its research note, B.Riley notes that the company’s competitive edge in the cybersecurity space stems from its robust blue-chip customer base. Additionally, OneSpan is experiencing strong demand for its authentication services, which are expected to continue growing as AI adoption intensifies. Akamai Technologies provides cloud computing, content delivery and cybersecurity solutions. Application and API security, bot and abuse protection, infrastructure security and programs supporting a zero-trust strategy are part of the offering. A zero-trust security strategy assumes breach is possible within networks and verifies every transaction accordingly. The remaining nine cybersecurity stocks were ordered by free cash flow (FCF) per share—highest to lowest—and the bottom three were dropped.

Best-in-Class Portfolio Monitoring

While the stock has shed nearly 20% in market value year to date, B.Riley views the company as a fundamentally attractive investment. To identify the best cybersecurity stocks to buy right now, we used the Finviz screener to compile a list of cybersecurity companies. We focused on companies developing solutions designed to protect against malware, phishing attacks, and ransomware.

Akamai sells to financial companies, video streaming companies, healthcare providers, retailers, pharmaceuticals and the U.S. military. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Learn how you can make money from the wave of seasoned companies innovating in AI and new AI tech companies. JustETF is the leading knowledge base for your ETF strategies. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Ready to uncover more transformative thematic investment ideas?

AI-Driven Security Boom Puts These 4 Cybersecurity Stocks in Spotlight

Yet this does provide an attractive entry point for investors seeking the best cybersecurity stocks. SailPoint (SAIL, $21.32) develops identity security solutions for enterprises. The SailPoint cybersecurity solution provides customers with extensive visibility across an organization.

Zscaler Business Overview

Beyond management solutions, they protect networks, gateways, data, and endpoints. Check Point stated in their Q4 results that they’re seeing growth in cloud networking and remote access security during the quarter. Palo Alto Networks is the largest pure-play cybersecurity operation in terms of revenue cyber security stocks and market cap.

Makes enterprise software that searches, analyzes, logs and visualizes data. The company is best known for its Elasticsearch application, used by popular apps like Uber, Instacart and Tinder. Elastic also offers an AI-powered security solution for detecting, investigating and responding to cybersecurity threats. In the October 2024 quarter, Zscaler reported 26% quarter-over-quarter revenue growth on “strong sales execution.” Operating cash flow was $291.9 million and 53% of revenue. The GAAP loss per share shrank to $30.7 million from $46.1 million in the prior year period. Zscaler operates a cloud security platform sold to customers on a subscription basis.

The stock sold off sharply in 2022, bounced back in 2023, and took another hit the next year. The roller coaster ride notwithstanding, Zscaler continues to deliver profitable revenue growth. The company’s eSignature technology also presents another growth opportunity owing to its high-end security capabilities. Consequently, the solution is expected to continue eliciting strong demand in the financial sector, as it meets stringent compliance standards.

The company reported annual recurring revenue (ARR) of $813.2 million in 2024, up 30% on a year-over-year basis. The number of customers that generate more than $1 million in ARR grew by 67%, and the total customer base is now more than 2,800 strong. However, analyst Adam Borg of Stifel Nicolaus is cautious about Rapid7’s growth prospects. Borg says the vulnerability management niche within cybersecurity may not provide the growth investors want to see from Rapid7. Despite Borg’s opinion, the average analyst earnings outlook for Rapid7 is positive.

- A bear market in 2022 clobbered some of the highest-flying stocks, followed by a wide range of shifting results.

- The company capitalized by building pioneering firewall systems for network security.

- Additionally, OneSpan is experiencing strong demand for its authentication services, which are expected to continue growing as AI adoption intensifies.

- The primary purpose of cybersecurity is to protect electronic data from damage or theft.

In the past three years, sales grew an average of 48% annually. To benefit from these trends, consider adding targeted cybersecurity exposure to your portfolio. Read on to meet six cybersecurity stocks with growth potential in 2025 and beyond. That percentage will likely rise as the cybersecurity landscape gets more complex. A World Economic Forum analysis cites several factors that are creating more complexity. They include hackers’ use of AI technology, rising geopolitical tensions and the increase in data protection regulations.

Amplify ETF Trust – Amplify Cybersecurity ETF

This result will push more hackers to find vulnerabilities in companies’ networks and systems to gain in a similar way. According to Morgan Stanley, the cybersecurity sector is expected to continue outperforming IT spending. The investment bank expects it to grow at approximately 50% faster than overall software expenditures. The robust growth is expected to present unique investment opportunities for investors as the number of cybersecurity firms continues to grow. SentinelOne’s longtime focus on endpoint protection, detection and response helps it fend off a variety of threats like malware and ransomware. These solutions would ultimately become part of SentinelOne’s comprehensive Singularity platform.

Our trade rooms are a great place to get live group mentoring and training. You can spend an entire day reviewing all its stocks and deciding which fits your investment goals. The future is powered by artificial intelligence, and the time to invest is NOW.

Our live streams are a great way to learn in a real-world environment, without the pressure and noise of trying to do it all yourself or listening to “Talking Heads” on social media or tv. CACI International is not just a cybersecurity play but a world-class information technology products, solutions, and services company. They provide information assurance, security, systems integration, reengineering, electronic commerce, and related services.

About The Author

Written by admintrans

Cart

-

FLANGE 6 HOLES 48MM

FLANGE 6 HOLES 48MMKSh 18,500.00Original price was: KSh 18,500.00.KSh 11,100.00Current price is: KSh 11,100.00. -

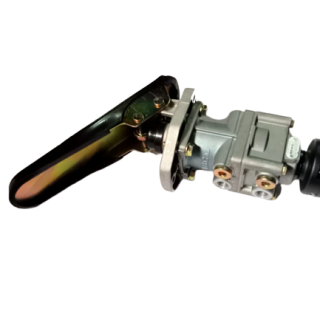

FOOT BRAKE VALVE

FOOT BRAKE VALVEKSh 20,000.00Original price was: KSh 20,000.00.KSh 12,000.00Current price is: KSh 12,000.00. -

INTERCOOLER INTAKE RUBBER PIPE

INTERCOOLER INTAKE RUBBER PIPEKSh 11,500.00Original price was: KSh 11,500.00.KSh 6,900.00Current price is: KSh 6,900.00.

Uncategorized

Uncategorized CA1073

CA1073 CA1081

CA1081 CA3223

CA3223 CA3320

CA3320 CA4181

CA4181 CA4322

CA4322

Leave a Reply