The speculations are rife that the Chinese Renminbi will displace the US dollars as the world’s RC in the coming years. The reports came out after witnessing a downturn in the economy of the US while China experienced a major economic boost. It is also predicted that the US dollar will soon share its influence with other currencies. As per a recent Reuters report, the US economy has created 467,000 jobs in January 2022, a huge milestone after the economic upheaval caused by COVID-19. As a result, the Dollar Index, reporting the value of the US dollar assessed against six other major reserve currencies, registered a growth of 0.1%.

Other Products & Services:

In summary, a reserve currency is a currency that serves as a benchmark for the value of other currencies and for international transactions on an international level. On the other hand, the U.S., with its liquid and significant financial market, is considered a safe haven. These reserve requirements are established by the Fed’s Board of Governors. Reserves also keep the banks secure by reducing the risk that they will default by ensuring that they maintain a minimum amount of physical funds in their reserves.

- “Chase Private Client” is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account.

- This suggestion is based on the opinion that the U.S dollar has become unstable in terms of its value in the global market.

- Proponents—including El Salvadoran President Nayib Bukele, who has made Bitcoin legal tender—argue that such a system would free countries from the whims of other nations’ monetary policies.

- After two world wars, the influence of the pound sterling diminished, after the wars weakened the British economy.

By the 1960s, however, the United States did not have enough gold to cover the dollars in circulation outside the United States, leading to fears of a run that could wipe out U.S. gold reserves. Following failed efforts to save the system, President Richard Nixon suspended the dollar’s convertibility to gold in August 1971, marking the beginning of the end of the Bretton Woods exchange rate system. The Smithsonian Agreement, struck a few months later by ten leading developed countries, attempted to salvage the system by devaluing the dollar and allowing exchange rates to fluctuate more, but it was short-lived. By 1973, the current system of mostly floating exchange rates was in place. Many countries still manage their exchange rates either by allowing them to fluctuate only within a certain range or by pegging the value of their currency to another, such as the dollar.

Sustaining Trust in the U.S. Dollar As a Reserve Currency

Though new currencies were added to the IMF’s list of RCs, the US dollar managed to sustain its top position. During the last one year (Q Q3 2021), US dollars have registered a growth of US $154.16 billion in the total foreign exchange reserves. A reserve currency is a national currency that is widely used and accepted in international transactions. It is usually the currency of a country with a large and influential economy. Tech evangelists dream of a world where cryptocurrencies such as Bitcoin replace government-backed currencies. Such digital currencies are “mined” and transferred via a decentralized network of computers without any issuing authority.

What role do central banks play in managing reserve currencies?

A reserve currency is a foreign currency that is held in significant quantities by central banks and other major financial institutions as part of their foreign exchange reserves. This type of currency is used in international trade and investment because of its stability and acceptance worldwide. Historically, reserve currencies have been those from economically dominant countries, making them a reliable store of value and medium of exchange on the global stage. A reserve currency is a foreign currency that a central stock trading vs investing bank or treasury holds as part of its country’s formal foreign exchange reserves. Countries hold reserves for a number of reasons, including to weather economic shocks, pay for imports, service debts, and moderate the value of their own currencies. Currency reserves are meant to stabilize economies and manage global exchange rates.

What are the implications of a country’s currency becoming a reserve currency?

A highly valued dollar makes U.S. imports cheaper and exports more expensive, which can hurt domestic industries that sell their goods abroad and lead to job losses. This imbalance can worsen during times of financial turmoil, when investors seek the stability inherent to the dollar. Some analysts argue that the cost of the dollar’s dominance for manufacturing-heavy U.S. regions such as the Rust Belt are too high, and that the United States should voluntarily abdicate. Other economists disagree, arguing that there will always be winners and losers with a strong dollar.

Understanding Currency Reserves

The global reserve currency gives its issuing country a pivotal role in the facilitation of international trade, and the overall health of the global market. For nearly 80 years, the US dollar has held this role, yet change looks to be on the horizon. Geopolitical tension, strengthening alternative coalitions and technological advancement are leading us into an exciting period of change for global finance, where the dollar’s supremacy may be realistically challenged. Reserve Currency is a globally-recognized foreign currency held in reserve by a country’s central bank for global transactions. Every country’s central bank has reserves usually made up of gold and a specific foreign currency held in substantial numbers. This foreign currency is deployed in international monetary dealings to make investments and settle debt liabilities.

- Central banks often hold currency in the form of government bonds, such as U.S. treasuries.

- Even with de-dollarization, the U.S. dollar remains the world’s currency reserve.

- A reserve currency refers to a strong currency, often a foreign currency used for international trade and to settle international debts and obligations.

These experts contend that losses for exporters are countered by gains for importers, and that overall, the situation is a net benefit to the U.S. economy. Manipulating and adjusting the reserve levels can enable a central bank to prevent volatile fluctuations in currency by affecting the exchange rate and increasing the demand for and value of the country’s currency. In the role as global reserve currency issuer, the US can use this to its advantage in the global economy.

For the US, this is a fantastic advantage, allowing for cheaper borrowing and significant leverage in international diplomacy. The term ‘global reserve currency’ refers to a currency that is held in large quantities by a government or institution, in order to conduct international trade, investments or other interactions on the global market. The reserve currency acts as a global common denominator amongst countries, for participating in international trade and finance. This simplifies cross-border operations, providing a stable and widely accepted medium of exchange. As the United States continued to flood the markets with paper dollars to finance its escalating war in Vietnam and the Great Society programs, the world grew cautious and began to convert dollar reserves into gold.

But because so much trade is conducted in U.S. dollars, other countries do not always see this benefit when their currencies depreciate. “Both the United States and the world at large would benefit from a less dominant U.S. dollar,” writes Michael Pettis, a professor of finance at Peking University. The dollar’s centrality to the system of global payments also increases the power of U.S. financial sanctions. Almost all trade done in U.S. dollars, even trade among other countries, can be subject to U.S. sanctions, because they are handled by so-called correspondent banks with accounts at the Federal Reserve. By cutting off the ability to transact in dollars, the United States can make it difficult for those it blacklists to do business. “There’s no doubt that if the dollar were not so widely used, the reach of sanctions would be reduced,” says Setser.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. For Foreign Affairs, Peking University’s Michael Pettis looks at the high price of dollar dominance. Vimeo is a video hosting platform for high-quality content, ideal for creators and businesses to showcase their work. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen. “Chase Private Client” is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account.

Benefits & drawbacks of holding a reserve currency

After the war ended, the restructured governments of the former Axis powers also agreed to use dollars for their currency reserves. Periodically, the board of governors of a central bank meets and decides on the reserve requirements as a part of monetary policy. The amount that a bank is required to hold in reserve fluctuates depending on the state of the economy and what the governing board determines as the optimal level. For now, however, the US dollar remains the lifeblood of the global financial system.

Proponents—including El Salvadoran President Nayib Bukele, who has made Bitcoin legal tender—argue that such a system would free countries from the whims of other nations’ monetary policies. But critics say adopting cryptocurrency as legal tender constrains a government’s policy options during a crisis, and that the volatility of cryptocurrency reduces its viability as a means of exchange. However, some countries are experimenting with using blockchain technology to create digital versions of their existing traditional currencies.

Over time, U.S. trade swung into a sustained deficit, supported in part by global demand for dollar reserves. By buying and selling currencies on the open market, a central bank can influence the value of its country’s currency, which can provide stability and maintain investor confidence. For instance, if the value of the Brazilian real starts to fall during an economic downturn, the Central Bank of Brazil can step in and use its foreign reserves to bid up its value. Conversely, countries can intervene to stop their currencies from appreciating and make their exports cheaper. One of the earliest examples of this was the Roman denarius, the widely accepted currency across the Roman Empire.

In the future, we may expect to see a more diversified mode of operation, where multiple currencies operate as global reserve currencies, with influence being spread across the globe. These shifts would be greatly impactful on all aspects of how the global economy operates, from trading to diplomacy. Since its inception in 1999, the Euro has gradually grown to become the second most widely held reserve currency in the world. Euro’s widespread acceptance and the economic strength of the Eurozone make it an attractive reserve currency for countries and institutions.

China has been trying to boost the global role of the renminbi, also known as the yuan, since the late 2000s. It currently accounts for 3 percent of global reserves, but China has increasingly pushed to use the renminbi in bilateral trade, especially in the wake of the Ukraine war. However, Chinese policymakers are wary of the lessons from previous currencies PDF that rapidly internationalized, and they have imposed strict controls on the flow of money that have hamstrung the renminbi’s growth. “China does not have the intention or the capacity to dethrone the dollar,” says CFR’s Zongyuan Zoe Liu. In addition to accounting for the majority of global reserves, the dollar remains the currency of choice for international trade. Major commodities such as oil are primarily bought and sold using U.S. dollars, and some major economies, including Saudi Arabia, still peg their currencies to the dollar.

The gold-dollar decoupling through the approach of the U.S government towards reducing the significance of gold reserves. This was predominantly done through printing or more U.S dollars that were backed by its Treasury debts and not the gold reserve. The U.S flooded both the domestic and international markets with dollars and this diminished the value of the gold reserve currency. The U.S as at this time printed more paper dollars which was used to finance the Great Society programs and the Vietnam war, this led to the response of dollar reserves being converted into gold. President Nixon also contributed to the decoupling of gold and dollar and this also led to the emergence of floating exchange rates.

About The Author

Written by admintrans

Cart

-

FLANGE 6 HOLES 48MM

FLANGE 6 HOLES 48MMKSh 18,500.00Original price was: KSh 18,500.00.KSh 11,100.00Current price is: KSh 11,100.00. -

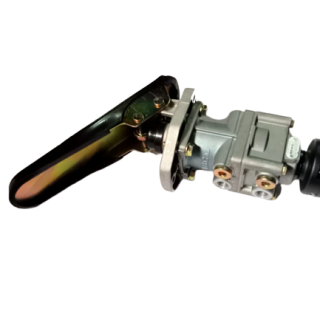

FOOT BRAKE VALVE

FOOT BRAKE VALVEKSh 20,000.00Original price was: KSh 20,000.00.KSh 12,000.00Current price is: KSh 12,000.00. -

INTERCOOLER INTAKE RUBBER PIPE

INTERCOOLER INTAKE RUBBER PIPEKSh 11,500.00Original price was: KSh 11,500.00.KSh 6,900.00Current price is: KSh 6,900.00.

Uncategorized

Uncategorized CA1073

CA1073 CA1081

CA1081 CA3223

CA3223 CA3320

CA3320 CA4181

CA4181 CA4322

CA4322

Leave a Reply